Our first pilot results

with BNP Paribas

In early 2024, our AI chatbot, SimONE, competed in a Champion-Challenger pilot against a subsidiary of BNP Paribas and its panel of External Debt Collectors.

Pilot Objectives

Prevent pre-delinquent customers from rolling into delinquency

SimONE prioritizes consumer help, giving Ubiquity AI the highest Meta Business Quality Ranking despite WhatsApp's automated engagement challenges.

SimONE proves WhatsApp is preferred across all demographic groups in South Africa, with a 98% penetration rate among financial service providers' digital platforms.

Financially-fragile consumers prefer AI agents over call centres due to fear, embarrassment, and poor knowledge. SimONE is the ideal engagement solution, with self-curing and asynchronous communications.

Debt collectors focus on targets, not consumers. SimONE prioritizes customer trust by understanding behavior and financial struggles.

Pilot results

Fewer customers assisted by SimONE, rolled into delinquency

1/ Roll-in Rate

2/ Right-party Contact Rate

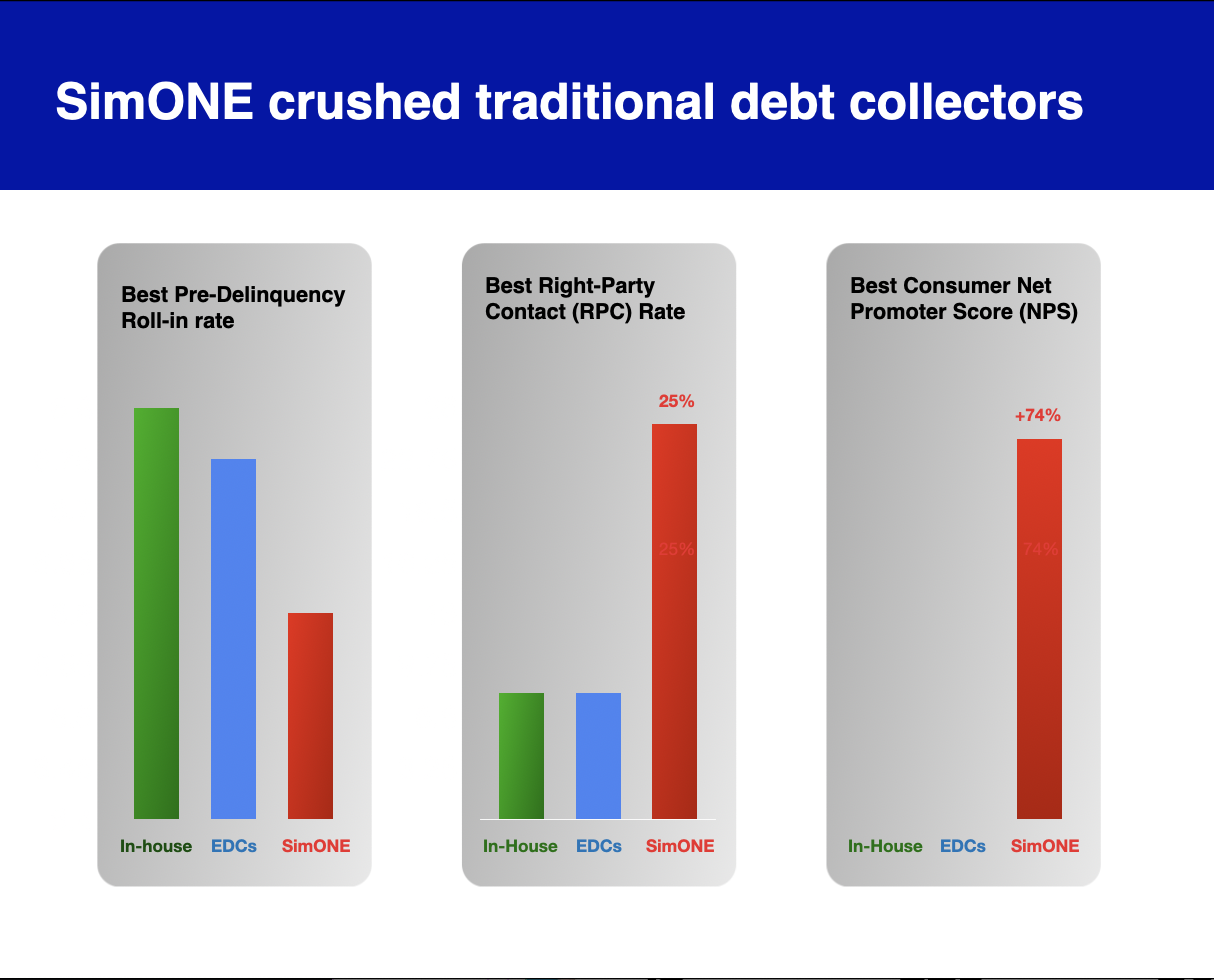

SimONE recorded a Right-Party Contact Rate of 25% of total unique accounts. Typically, EDCs mostly contact consumers via text or email, with extremely low RPC rates. Telephonic RPC rates are higher than digital, but call avoidance and penetration rates are a major challenge in collections.

3/ Customer Satisfaction

Debt collectors typically do not measure NPS and those that do, do not share that data as NPS scores are usually negative. SimONE achieved an unprecedented 74% Net Promoter Score, and 25x higher engagement than traditional digital methods.